Case Studies

Baillie Gifford

How Baillie Gifford Is Bringing Social Impact to Public Equity Investing

Climate Change affects every corner of the Earth, from expanding deserts to flooding coasts to longer droughts and more powerful storms. While governments debate treaties, targets, and solutions, there’s no way we can stave off the worst without business leading the charge. Denmark’s Ørsted is a perfect example. The company was founded to manage and grow the massive oil and gas resources of the nation of Denmark, and faced with the realities of climate change made the forward-looking decision to sunset their oil and gas holdings and move their entire business to sustainable energy. Since 2006, Ørsted has reduced carbon emissions by two-thirds, while operating profits have quadrupled.

We can read that and cheer, but for a company like Ørsted a transition from dirty energy to green faces tremendous hurdles. Ørsted is a publicly-traded company, beholden to shareholders in its business decisions. For many of the largest companies on Earth, doing the right thing can mean being punished by investors who prioritize short-term profit over everything else. That’s where an investor like Baillie Gifford comes in. Baillie Gifford is a 110-year old investment firm based in Edinburgh, Scotland. They practice a time-tested investment philosophy of deploying patient capital – prioritizing long-term growth over short-term gain — to a concentrated mix of companies delivering strong financial returns.

Change takes time. Social and environmental challenges such as persistent poverty and climate change cannot be solved with a short-term mindset. If the financial capital required to solve these issues is to be effective, that capital will need to be patient. By taking a long-term approach to investing Baillie Gifford’s Positive Change strategy aims to support companies making decisions and taking actions that will be beneficial for their business, society and the environment in the coming years and decades. That also makes business sense: companies whose core business activities are addressing global challenges will experience rising demand for their products and services: they have phenomenal growth opportunity.

The Positive Change Strategy

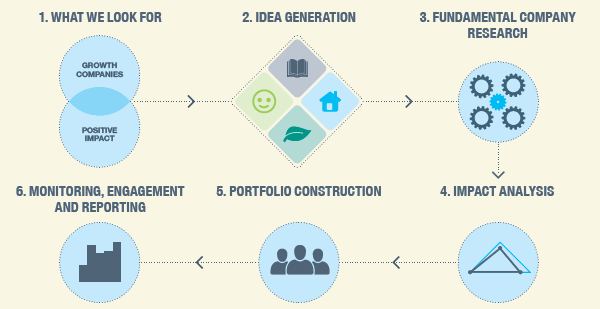

Baillie Gifford’s belief is that owning shares of exceptional businesses whose products and services are having a positive impact on society is a more effective way of delivering positive change than avoiding those doing harm: they take a positive and proactive approach. This philosophy goes beyond traditional Environmental, Social and Governance (ESG) investing — utilizing material nonfinancial information to price risk appropriately – but it’s a natural extension of how Baillie Gifford has been investing for decades. “Engaging with companies and investing responsibly for the long term is second nature to us,” said Catherine Flockhart, Director at Baillie Gifford. “We build strong relationships with management teams to help new companies grow, and to help more established companies continue to improve on what they’re already doing well.”

The team at Baillie Gifford, wanted to do something above and beyond what they were already doing. While Baillie Gifford already took a thoughtful approach to long term investment and had some products that screened out companies that are perceived to cause harm, the Positive Change team wanted to intentionally invest in companies that are making a specific and measurable positive impact. That desire became the Positive Change strategy. “Purpose compliments profits. There’s no tradeoff between companies that are doing good things and companies that will perform well long term,” said Catherine. The Positive Change Strategy is a concentrated, global equity fund that invests in high-quality growth companies which can deliver positive social change in one of four areas: social inclusion and education, environment and resource needs, healthcare and quality of life; and addressing the needs of the world’s poorest populations.

The Proof Is In the Impact Pudding

The Positive Change strategy has a powerful mission, and it was also a new way of doing business. In the investment world, new ways of doing business require rigorous proof in order to bring your clients along. The Positive Change strategy was in development for over a year before Baillie Gifford’s partners seeded it with capital of 1 million pounds. When they started the strategy, the team was already very thoughtful about what they wanted to see from a financial risk and return perspective in their long-term investments and the social challenges companies should be addressing, but they didn’t know how to clearly demonstrate the second objective: delivering real social and environmental impact in consistent and measurable ways. “How do you consistently assess social impact before you buy a share in a company?” Catherine asked. “That was the challenge we faced.”

“During that first year of developing Positive Change, we had tried to develop ways to demonstrate impact in-house, and on a company-by-company basis. Those first attempts were bespoke, very time intensive, and lacked high-level portfolio metrics,” Catherine said. The team knew that we were trying to create from scratch something that has a whole industry of expertise already behind it. They had the foresight to know that some outside advising could be invaluable for long-term success.

Attribution: Baillie Gifford 2017 Impact Report

As Baillie Gifford was doing their search, they had Pacific Community Ventures (PCV) referred to them by one of their existing foundation clients who had made investments with Baillie Gifford over several years, and had retained Pacific Community Ventures for various impact measurement and reporting projects. “When we started looking for a consultant, we honestly didn’t know how much value we’d get out of it. PCV really got it — and unlike some other consultants we talked to, they treated impact as a discipline unto itself.”

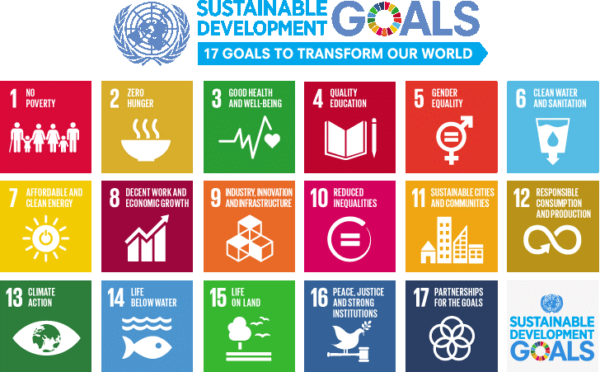

“We felt in working with PCV, we could be set up for success and at the same time our team members could work with PCV to develop best-in-class impact measurement and management techniques.” Baillie Gifford and PCV wanted to build the case for public equity investing as an attractive impact investing strategy: Positive Change seeks to demonstrate to the investment industry that a concentrated public equity portfolio focused on advancing progress toward the United Nations’ Sustainable Development Goals can also achieve competitive financial performance, and in so doing, attract additional institutional investment capital to the impact investing space.

Finding The Right Impact Management Expert

“When we started our partnership, we liked that PCV would work WITH us to develop the impact management framework, so we could take it over after the fact,” Catherine said. “As a firm, we like to build expertise in-house, so that model was perfect for us to fill the gaps in our knowledge. It really fast-tracked our learnings, and PCV really understood our culture” The PCV team interviewed all of the managers involved in the Positive Change strategy and found that some had some slight differences of definitions when it came to impact. The Baillie Gifford team didn’t come with any pre-conceived notions of what their approach should be and hearing each team members goals for the strategy and how they understood impact helped PCV in sharpening the team’s understanding of the targeted impact and how best to achieve it.

The work that PCV and Baillie Gifford did together was substantial: ESG risk analysis is key in public equity markets, which involves integrating lots of outside ratings, but we also wanted to ensure we demonstrated and understood ESG opportunities. We worked on integrating those into their process and creating logic models to inform investments. More specifically, PCV helped develop individual logic models for each of the strategy’s impact themes that demonstrated the link between the strategy’s investees’ activities, outputs, outcomes, and long-term impact, including progress towards the targets of each of the UN’s Sustainable Development Goals. Before a stock was purchased, for example, we worked together to refine their pre-buy analysis from 4 impact areas to 3. “It was a benefit to us having someone take a fresh look at our process. We gained a consistency and a robustness of analysis after working with PCV on the frameworks we were going to use.”

When PCV started working with the team at Baillie Gifford, they were determined that their impact objectives be able to withstand the skepticism that new market entrants and those investing in publicly-traded companies claim to support positive change yet have no evidence that their investments contribute to achieving their social and environmental objectives. Baillie Gifford confirmed that the impact measurement and management frameworks from PCV did just that. Catherine said, “It was key to us that Positive Change not be associated with ‘impact washing’ concerns for a second. Working with PCV added total credibility around that and provided reassurance for our clients.”

Everything the PCV team suggested had key measurements that could be tracked and reported on to showcase actual social or environmental change created by publicly-traded companies. When it came to differentiating Baillie Gifford’s Positive Change strategy from other public equity strategies, PCV believed that their longstanding value proposition of patient capital set them apart and was in strong alignment with driving impact. Baillie Gifford can support companies’ ability to achieve long-term social performance instead of only short-term profit and support management in resisting other investors’ efforts to pressure the company to compromise long-term vision for short-term gains.

Attribution: Baillie Gifford 2017 Impact Report

Taken as a whole, the Positive Change team is excited that this framework will enable the firm to go beyond just meeting its mandate, providing the opportunity to differentiate the strategy from others in the space. Catherine said that having a strong impact measurement and management system sets a high bar for the assessment of non-financial performance, and hopes it helps to position Baillie Gifford as a leader in the public equity impact investing space.

Working With PCV Helped Turn Positive Intent Into Positive Change

Positive Change is in its early days, considering Baillie Gifford’s 5-year horizon for investing in and evaluating companies. The strategy is growing considerably. Catherine told us, “There’s a lot of talk about these days with green indexing and screening investments, but if you want to invest to change the economy you need an active approach, not a passive one. Our investors are very happy, and the ability to measure and demonstrate impact has been an invaluable part of that. People have been very complementary by our impact reporting. It demonstrates our credibility in the eyes of investors.”

Both Baillie Gifford and PCV have enjoyed the collaborative nature of their relationship and expect to continue working together, focusing on the continual refinement of the Positive Change strategy’s impact management to both inform and align with industry best practice. Currently the team is exploring more robust assessment of negative impact. Generating direct impact through investments in public equities requires a thoughtful approach — there is no “perfect” company, and impact is complex and will always have gray areas. A patient capital investor like Baillie Gifford that partners with companies over the long term is the kind of investor that good companies need so they can really integrate social and environmental considerations into their business.