A NOTE FROM OUR CEO

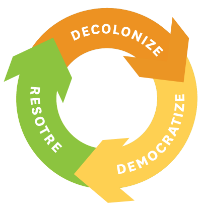

Pacific Community Ventures is embarking on a new strategy that grounds us in experimentation and research, and focuses us on decolonizing, democratizing, and restoring our communities.

Childcare — from daycare owners struggling to stay open, to daycare workers striving to get the pay and benefits they deserve, to working parents scrambling to afford adequate care with no help from the Federal government — has in many ways come to define the last two years. La Plazita preschool in Oakland is a true Spanish Immersion preschool where kids learn or retain Spanish, while fully preparing for Kindergarten. In the years before COVID-19, La Plazita’s first location quickly became successful, and when it came time to expand to a second location with a more direct community focus in Fruitvale, owner Krystell Guzman was eager for guidance. That is when Pacific Community Ventures came in. She received advice through our Pro Bono Business Advising program and eventually opened two more locations, employing 38 people and, in the spirit of our motto “Good Jobs, Good Business,” Krystell offers healthcare and retirement benefits to all of her employees.

There are hundreds of stories like Krystell’s, and while banks often say “no,” at PCV, we always try to come from a place of “yes.” In November 2021, we launched our Oakland Restorative Loan Fund — $2.5 million in no fee, zero-interest loans for small businesses located in low to moderate income neighborhoods — the first effort under our new strategy to decolonize capital. Krystell applied for an Oakland Restorative Loan Fund loan and received it this January. During a very challenging year, in which many parents opted to keep their children home, La Plazita closed for 2 months, and upon returning, only 5% of their kids came back right away. Krystell told us she intended to use her loan to stabilize her business.

Now that they’ve built back, she’s using the zero-interest loan “to continue growing the schools, maintaining the jobs that we have, and providing better wages to our employees.” As a working mom and former small business entrepreneur myself, I stand with the parents and staff who needed Krystell to succeed in their community for their economic well-being, especially knowing that the lack of affordable childcare led to a great drop of women in the workplace during the pandemic.

We built this zero-interest fund because that’s what small business owners in our community told us they needed over the past year. When we launched it, however, we heard some surprising pushback from other community investors: that this was distorting the market. To them, small business owners like Krystell were “acceptable losses” in an economic downturn, where it is expected that many businesses will fail. We refused to accept this loss, and strive to help entrepreneurs like Krystell preserve as much as possible for the well-being of her business, her workers, and her community.

Our Oakland Restorative Loan Fund and centering Black, Indigenous, Latinx, and AAPI entrepreneurs are integral to PCV’s mission of creating a just economy and good jobs with dignity for all working people. People of color start more businesses each year than anyone else, and in 2021 communities of color saw the largest surge in new businesses in decades. Black and Latinx women, especially, have become the new face of entrepreneurship in the US. Women of color account for 89% of the new businesses opened every day, but almost 75% of women of color say their most common obstacle to growth is a lack of capital. In 2021 only 13% of Black business owners and 20% of Latinx business owners got the loans they applied for, and only 1% of venture capital dollars were invested in Black founders.

PCV was one of America’s first impact investors when we were founded — and CDFIs like us were created out of the Civil Rights Movement with the purpose of getting capital to low-income and communities of color. With so many Black, Indigenous and POC communities still struggling with injustices stemming from the past, our new strategy takes PCV’s foundational values into the future.

Two things make impact investing different from traditional investing:

1. Intent — Design your investment to impact the social or environmental problem you’re looking to solve; and

2. Measurement — Make certain your investment accomplishes that goal over time.

With our new strategy, PCV is embedding these even more deeply into the design and delivery of all our products and services. We are fully embracing our founding principles of impact-first investing to DECOLONIZE, DEMOCRATIZE, and RESTORE access to fair and affordable capital and mentorship for the communities we serve.

As we combat a constantly changing economy and system, it is crucial that our work be adaptable and rooted in learning, research, and experimentation. This is where our new Good Jobs Innovation Lab comes in. While our Small Business Lending and Advising programs will continue to connect entrepreneurs to accessible expertise and restorative capital, the Good Jobs Innovation Lab will establish a regular process of research and experimentation to ensure that our programs grow with and actively impact our communities’ changing needs, empowering workers alongside business owners and building wealth.

In 2022, as we launch our new strategy, PCV is going deeper into place-based community-led and designed ecosystem approaches across California, starting with our hometown in Oakland. We will also partner more deeply with community organizations and other CDFIs across the nation through our pro bono Business Advising program. Our advising will match the diversity and lived experience of the entrepreneurs and communities we serve, and support both business growth and worker empowerment, towards our goals of helping business owners like Krystell be agents of change in their communities and catalyze racial and community wealth. Decolonizing capital works — and this is how we start. By dismantling the rules and constructs long inherited in the financial industry that keep too many out, and design them by, with, and for the communities we serve. As PCV prepares to celebrate our 25th anniversary next year, we are both going back to our roots as one of the U.S.’s first impact investors, as well as the Civil Rights foundations of our CDFI industry, to decolonize, democratize, and be restorative with the people and places we serve. Join us!

In Solidarity,

Bulbul Gupta

President & CEO

Pacific Community Ventures

OUR IMPACT IN 2021

With our lending across California, and our nationwide Business Advising program, PCV was able to reach 1,681 small business entrepreneurs with capital and/or advice — largely through those closest to their communities — our local community and CDFIs partners.

WHERE OUR CAPITAL IN 2021 WAS INVESTED:

Our restorative capital client companies are also growing and advancing the quality of the jobs they offer:

Business

Advising

PCV’s new strategy — centering restorative capital and pairing it with business advising and good jobs research supports — moves the needle on entrepreneurs’ and workers’ financial security, health, wellbeing, and wealth-building.

AMONG THE PEOPLE OF COLOR WE SERVE*:

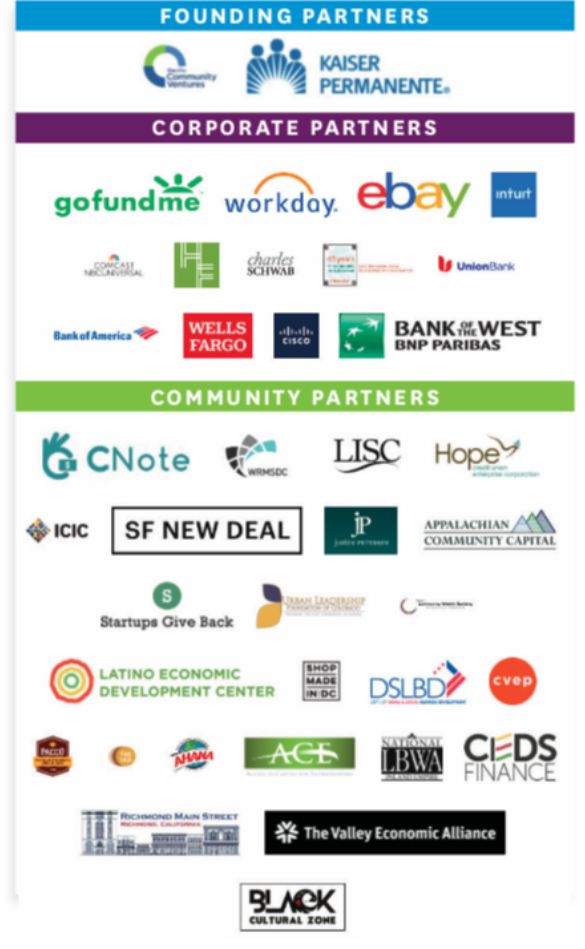

Across the country, we reached 1,500 small business entrepreneurs through our Business Advising platform, in partnership with an additional 22 CDFIs and community partners in our Small Business Support Circle:

RESTORATIVE CAPITAL

Fair & Affordable Capital Across California

Our lending program doubled in 2021, setting a record with $10 million in capital deployment and 90% going to women and BIPOC entrepreneurs.

Who We’ve Worked With

76% of loans were deployed to people

of color in California (up from 72% last year):

Time in Business:

Our portfolio is based on economic, racial, and gender justice:

SMALL BUSINESS ADVISING

Closing The Small Business Advice Gap

Our Business Advising program continues to grow year over year. In 2021 our program grew by 53%, serving 1,500 small business owners with a record 1,800 advising matches — over 200% since 2019 — with 88% of our entrepreneurs being women-identifying and/or entrepreneurs of color.

Advisor Cohorts

To make sure our volunteer advisors are best equipped to support entrepreneurs, we’ve introduced PCV Advisor Cohorts — groups led by PCV- trained advisors and aimed at fostering collaboration, resource-sharing, and training opportunities among members. Each cohort will center on a specific subject matter (like Good Jobs Advising) to create solid frameworks and flexible approaches to small business mentorship. By pooling knowledge, experience, and conversation among industry professionals, our Advisor Cohorts deepen advisor-entrepreneur partnerships, bring tailored advice, and help small business owners receive the best advice they need to recover from the pandemic and grow sustainably.

View some of our Advisor Cohort Sessions here.

The Small Business Support Circle

To help mitigate the impact of COVID-19 on the small businesses that make up nearly half of our economy and help them rebound and grow sustainably, PCV has brought together a rapidly growing coalition of companies and organizations invested in the success and resilience of small businesses across the United States. We call this initiative the “Small Business Support Circle” and it’s working to get millions of dollars of free advice into the hands of job-creating small business owners everywhere.

Through their partnership and generous funding, members of the Circle are helping PCV to leverage and scale our unique BusinessAdvising.org pro bono advising platform to provide small businesses with the support they need to weather these tumultuous times.

“When you’re at the top, you don’t have anyone to bounce ideas off of…to have someone to speak to with an outside perspective is very helpful.”

Become an Advisor with PCV!

When Gail Brown’s father started Brown & Brown Realty in St. Louis in 1960, he did so with one thing in mind: to help disenfranchised Black homeowners find the housing they needed in the face of racist “redlining” practices across St. Louis. Gail grew up in the business, and when she took over the renamed Brown-Kortkamp Realty as owner in 1995, her attitude towards providing equitable options to residential and commercial property owners was exactly the same. Two once-in-a-lifetime economic crises have made it increasingly difficult for Gail to live her mission and provide her community with the services they need — but Pacific Community Ventures and our Small Business Support Circle are working to change that.

Missouri-based Justine Petersen is a founding member of PCV’s Small Business Support Circle since September 2020. Through them we were introduced to Gail, and connected her with Jennifer Levy — a former Partner at Rockwood Capital and current board member on the San Francisco-Marin Food Bank. Jennifer’s outside perspective helped Gail make some tough decisions around going remote, and rethinking some of her storage leases — helping Gail recoup $1,500.00 in overhead each month. And she says the headspace this partnership gives her is invaluable. “When you’re at the top, you don’t have anyone to bounce ideas off of,” she also explains. “For entrepreneurs — especially leaders who run their own business — to have someone to speak to with an outside perspective is very helpful.”

THE GOOD JOBS INNOVATION LAB

Prioritizing Employee Health Alongside Business

Health for Wealth-Building Outcomes

We launched our Good Jobs Innovation Lab to design interventions within PCV’s lending and advising offerings geared towards improving the financial security, health, and wellbeing for workers at small businesses. PCV continues to be one of the only organizations that works with small businesses on job quality, businesses who also have the least resources and support to enact job quality improvements.

Working alongside our lending and business advising programs, the Good Jobs Innovation Lab is identifying the best supports, policies, and innovations that help entrepreneurs grow their businesses sustainably, empower their workers through the power of good quality jobs, and impact their communities in the long-run.

For over 20 years, PCV has been a national leader in the drive to create good jobs.

PCV companies care about creating good jobs:

POLICY & ADVOCACY

Changing the rules of the game

For CDFIs to manifest the intentions set out by Civil Rights leaders to serve both racial and economic justice, we cannot be siloed from one another. We must work together to create lasting systemic change, impactful thought leadership, and transformative policy. While PCV’s day-to-day work centers on our small business clients, our Good Jobs Innovation Lab elevates that work and advances CDFIs and impact investors everywhere. We work closely with our investors and funders to ensure that capital and support comes to us in ways that allow us to be restorative. That only goes so far. Our advocacy allows us to amplify the voices of entrepreneurs, workers, and communities whom the government and private sector have largely failed, for broader systems change to make the rules of the game more fair, affordable, accessible for all.

Policy Briefs & Reports

2021 FINANCIALS

Our Mission

Pacific Community Ventures works side-by-side with communities in the fight for economic, racial, and gender justice.

THANK YOU TO OUR FUNDERS!

- AARP Foundation

- The Aspen Institute

- Bank of America

- Battery Powered

- CalPERS

- Capital One

- CDFI Fund

- CIP

- Citi Foundation

- City National Bank

- CNote

- Comerica Bank

- Community Investment Guarantee Program

- Community Vision

- CPCA COVID Recovery Fund Evaluation

- East Bay Community Foundation

- eBay Foundation

- Egyptian-American Enterprise Fund

- GoFundMe

- HSBC

- ICIC

- Jewish Community Federation

- Kaiser Permanente

- Lendistry

- Local Initiatives Support Corporation (LISC)

- Mercy Investment Services

- Northwest Area Foundation

- New World Foundation

- Opportunity Finance Network

- Small Business Administration

- San Francisco Foundation

- Sierra Club Foundation

- Silicon Valley Community Foundation

- Starbucks

- UCSF

- Union Bank Foundation

- U.S. Department of Treasury, CDFI Fund

- Umpqua Bank

- Wells Fargo

- Workday

- Wurwand Foundation

OUR BOARD OF DIRECTORS

UPCOMING 25TH ANNIVERSARY

As PCV prepares to celebrate our 25th anniversary next year, we are both going back to our roots as one of the U.S.’s first impact investors, as well as the Civil Rights foundations of our CDFI industry, to decolonize, democratize, and be restorative with the people and places we serve.